As we approach one of the holiest holidays in Geekdom – May the 4th – I’ve been reflecting on the Star Wars franchise. With inflation having a major impact on the cost of, well, everything, some are turning to selling collectibles to capitalize on the comfort of the nostalgia market and generate extra income. It got me wondering: if someone had had the foresight to buy and hold onto Star Wars toys to sell today, would their investment have beaten the market? As it turns out, the answer to that question is more complicated than I expected, but I wanted to figure out a solution. Because do or do not, there is no try.

A long time ago, in a galaxy far, far away…

Almost 45 years ago, on May 25, 1977, the first movie (fourth chronologically) in a series that today boasts 4 perfect outings, 3 so-so movies, and 2 garbage fires amazed moviegoers across the nation with mind-blowing special effects and a great will-they-won’t-they love triangle which would later become very awkward: Star Wars. After becoming one of the world’s hottest franchises, the market for Star Wars memorabilia skyrocketed, with some action figures from the original movie commanding high prices on today’s market.

The unprecedented popularity of the first Star Wars film resulted in a huge demand for toys, one which neither visionary director George Lucas nor toymaker Kenner had predicted. As a result, production seriously fell behind, and for the 1977 holiday season, parents could only purchase a “Early Bird Certificate Package” which contained a display stand, stickers, and a certificate that could be mailed in to claim the first four Star Wars action figures: Luke Skywalker, Princess Leia, Chewbacca, and R2-D2. The line would later expand to include 8 additional figures which all are valuable in today’s terms. These first 12 figures are the ones I used to complete this highly scientific* analysis.

*More like science-fiction-tific analysis. This is all just for fun, folks.

Source: HobbyLark

Source: HobbyLark

These ARE the Toys You’re Looking For

Note: Data sources are discussed in the Methodology section at the end of this content.

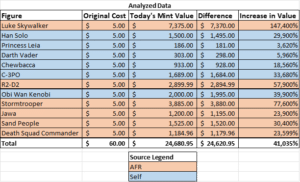

The average original cost of each Star Wars action figure was $5.00. With the toys releasing between 1977 and 1978, I used 1977 as the starting point for looking at the market. Using historical data for the S&P 500, I found that had you invested $60.00 (the cost of all 12 toys together) in 1977, you would have roughly $9,789.48 today. This is a 16,215.8% ROI (12.2% per year. Not too shabby! But how did the toys stack up?

In analysis, I found that the vast majority of Star Wars action figures beat the market individually, with Princess Leia and Darth Vader’s figures being the only notable exceptions. As a collection, the value of the toys increased 41,035% from 1977 to today. This means that for the initial $60 investment in the toys, if kept in Mint condition, you could receive $24,680.95 by selling them today. This beats the S&P 500 by a whopping $14,891.47.

The major issue with trying to capitalize on nostalgia is predicting it: you never know what hot commodity today will be valuable in the future, and what will be relatively worthless trash. But, if you had the foresight to hold onto some old Star Wars toys, congratulations! I guess every once in a while, both suns shine on a womp rat’s tail.

Appendix – Methodology

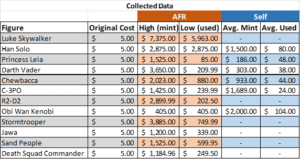

The number of Star Wars toy pricing guides is staggering, but in general, I found two to be the most comprehensive: Action Figure Resource (AFR) and Self. AFR’s data incorporates list and sale prices across several auction and collector websites and resources, while Self’s data incorporates only sale prices from eBay listings. Because Self’s dataset includes verifiable value from sales, where data was available, this was the default point of comparison. In all other cases, I used AFR’s data points. This is denoted in the graph above using color (orange for AFR, blue for Self). The average price of the toys upon release was $5.00 per figure.

All data observed is only shown for figures listed in Mint or Unopened condition. There’s a whole range of factors that go into grading a toy’s quality (seriously, there are a ton of resources out there about this specifically), but for the purpose of this analysis, I specifically looked at these figures as an investment. Therefore, I defaulted to the toys being kept safe and unopened, thus selling on today’s market at Mint condition.

The market indicator I compared against was the S&P 500, due to its longevity and relative stability.