Forward Guidance

Media Relations

in a Time of Crisis

Ishviene Arora

Media Saturation

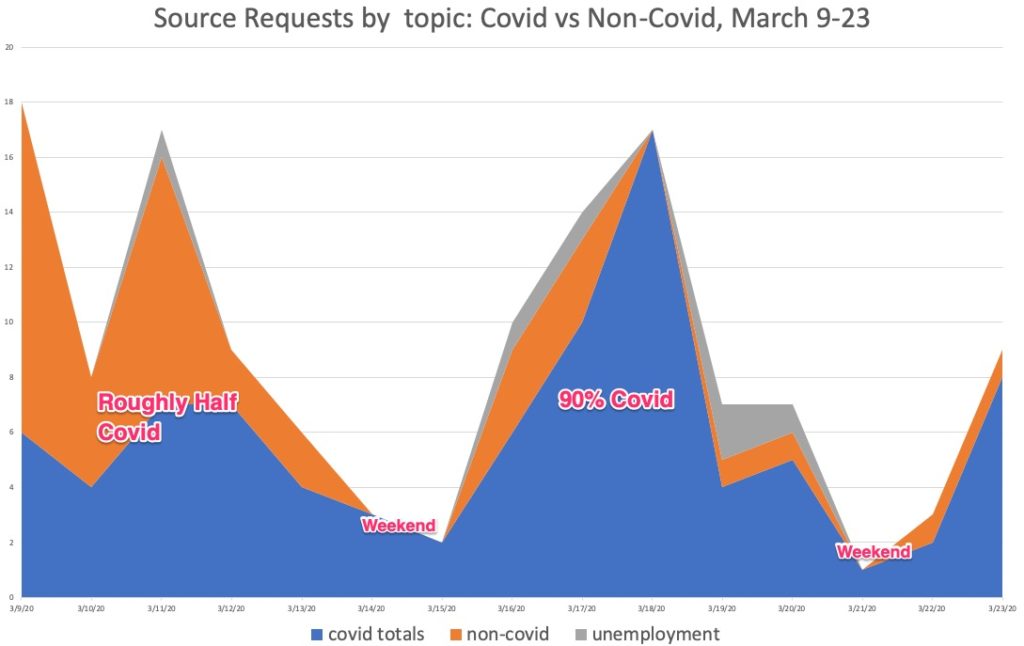

As COVID-19 continues to rage through the global landscape, the coverage of this across news outlets has skyrocketed. Data from our proprietary Qwoted platform indicates that we have almost hit peak media saturation. During the week of March 9th we can see roughly 50 percent of source requests were related to Coronavirus. However by the next week, the week of March 16th, about 90 percent of the source requests were related to Coronavirus:

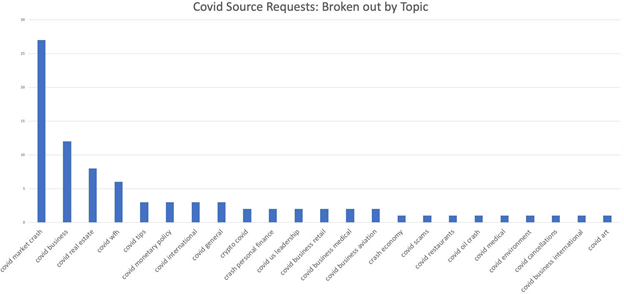

Among the top subjects for media requests were the market crash, how the virus is impacting businesses and how employees are working from home. We are seeing a “chain of consequences” in how the media is approaching its coverage of these events, with an initial focus on the virus and quarantine itself morphing week-by-week into ‘downstream’ stories, including impacts on employment, the federal response and stimulus bill and mental health. Commentary around the economic consequences of COVID-19 remains in high-demand, with source requests including:

- Financial advice for affected by the Coronavirus

- The impact of COVID-19 on the global economy

- The impact of the Coronavirus on the fintech industries

Looking Ahead

As journalists continue to cover a broadening set of topics related to COVID-19, we are beginning to see more industry-specific inquiries. With an incoming stimulus package, expect reporters to break down what this means for consumer financial health, businesses, and the larger economy. From a leadership and management perspective, the ongoing challenges that come with managing a remote workforce for a prolonged period will continue to be top of mind for the media.

To that end, some highly-searched terms inside of Qwoted are:

- covid stimulus

- covid olympics

- covid crowdfunding medical bills

- covid social security impact

- covid online shopping

- covid rich people

- covid fashion

- covid worship from home

- covid marijuana

- covid mental health

- covid disclosures: should public companies disclose how many of their staff have COVID

Preparing PRs

We know from our client communications that in-house PRs are also preparing for questions about business continuity, share prices, employee relations and other sensitive topics throughout the epidemic. Below is an overview of the types of questions we’ve both heard, and anticipate hear, from reporters to various financial institutions as COVID-19 plays out:

Business Operations Questions

- Firm-Wide

- How are you adjusting your equity and fixed income strategies? Are you reallocating? If so, how?

- Have you seen a significant drop in AUM? How does this impact your overall business strategy?

- Lending

- Are you reassessing any loan terms in light of hardships caused by COVID-19?

- Are you allowing deferrals of loan payments? Forgiving any related late fees?

- Are you allowing any mortgage deferrals for any CRA clients?

- Are you temporarily changing the way you review pre-approval applications that have recently been submitted?

- How has the market crash impacted your portfolio secured line of credit offering? How are you dealing with clients who have taken out this line of credit?

- Have you seen a rise in the number of professional loan applications that have been filed as a result of COVID-19’s impacts?

- Have any clients rescinded their residential loan application due to the market drop?

- Have small business clients pulled back on their efforts to raise capital to expand?

- Are you reassessing any loan terms in light of hardships caused by COVID-19?

- Private Banking

- Have you seen an uptick in significant cash withdrawals from accounts?

- Are you including any updates or COVID-19 messaging on your mobile or online banking platforms?

- Wealth Management

- How are you advising clients who are near retirement? How has this group been impacted?

- How are you reallocating or rebalancing client portfolios?

- How much of a long-term impact do you think COVID-19 will have?

- Are you recommending any hedging strategies to clients?

- Are you advising clients to take advantage of oversold markets?

- Have clients been pulling back on their charitable giving strategies?

As always, we hope you and your team find this helpful and would be curious to hear any additional thoughts or experiences you’ve had in working with reporters during COVID-19.