Across much of the U.S., spring is in full swing. The pollinators are out, the flowers are in bloom, and I have sneezed approximately 10,000 times. If you invested an inordinate amount of time into the plant life surrounding your home during the COVID-19 pandemic, you’re not alone. The home and garden sector has thrived over the past two years, with average household spending on lawn care and gardening services and activities increasing dramatically in 2021.

April is National Lawn & Garden month, and if the old “April showers” adage is to be believed, that makes May the month of flowers. While the floral (cut flower) industry took a hit during the pandemic (seeing a solid bounce back for Mother’s Day this year) the lawn and garden sector has hit record spending.

At the height of pandemic shutdowns from March to May 2020, when compared to the previous year, the material building and garden retail sector saw a sales revenue increase of 8.6%, according to the U.S. Census Bureau. In April 2020 alone, home and garden brands saw an order volume increase of 55%. According to the Bureau of Labor Statistics, average spending per household on lawn care and gardening services rose from $141.04 in 2016 to $177.07 in 2020, with the pandemic accelerating a spending trend that was already taking shape. Perhaps during shutdowns many looked around at their surroundings and decided they needed beautified.

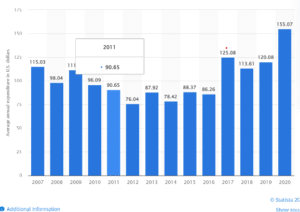

Interestingly, the average household expenditure on lawn and garden supplies sharply increased from $120.08 in 2019 to $155.07 in 2020, signaling that many stay-at-homers were interested in doing the work themselves, not just paying for landscaping or other professional services. While the increase is dramatic, this too continues a recent trend of increased household spending.

This may be in part due to millennial interest in self-sufficiency and growing their own foods. Vegetable/seed sales have increased as dramatically, if not more so, than standard flowers/trees/landscaping, and demand for food plots from professional landscapers has been on the incline. In the face of rising inflation, fear over recession, and increasing grocery bills, this may be a trend we see continue to gain traction as more households look to save on food costs.

So far, it doesn’t seem that inflation is dissuading investment into these spaces in 2022. Recession looming or not, the lawn and garden industry looks well situated for the future. According to a report published by Grand View Research, the b2c lawn & garden eCommerce industry alone could grow by $102 billion between 2020 and 2024.

As it stands, the month of May seems like a great time to be a flower, or a lawn and garden retailer. If April showers bring may flowers, April spending make its rain.